Feeling worn out by the cycle of living from one paycheck to the next, uncertain about where your earnest efforts are flowing? 50/30/20 Rule of Budgeting will help you here. Dreaming of gaining better command over your finances and realizing your financial aspirations? Your search ends here! In this blog post, let’s delve into the 50/30/20 budgeting rule – a straightforward and powerful strategy that empowers you to steer your financial journey with an Indian touch and a humane perspective.

The Basics of Budgeting

Budgeting is like the secret ingredient in the recipe of financial success. Before we Look into the details of the 50/30/20 rule, let’s take a moment to understand why budgeting is so important. Budgeting is like crafting a roadmap for your money, making sure it’s utilized judiciously to meet your financial objectives. This practice empowers you to monitor your earnings and expenditures, spot opportunities for cost-cutting, and, in the end, nurture a culture of saving. So, let’s explore the art of budgeting with an Indian touch and a human touch to make your financial journey more meaningful.

What is the 50/30/20 Rule?

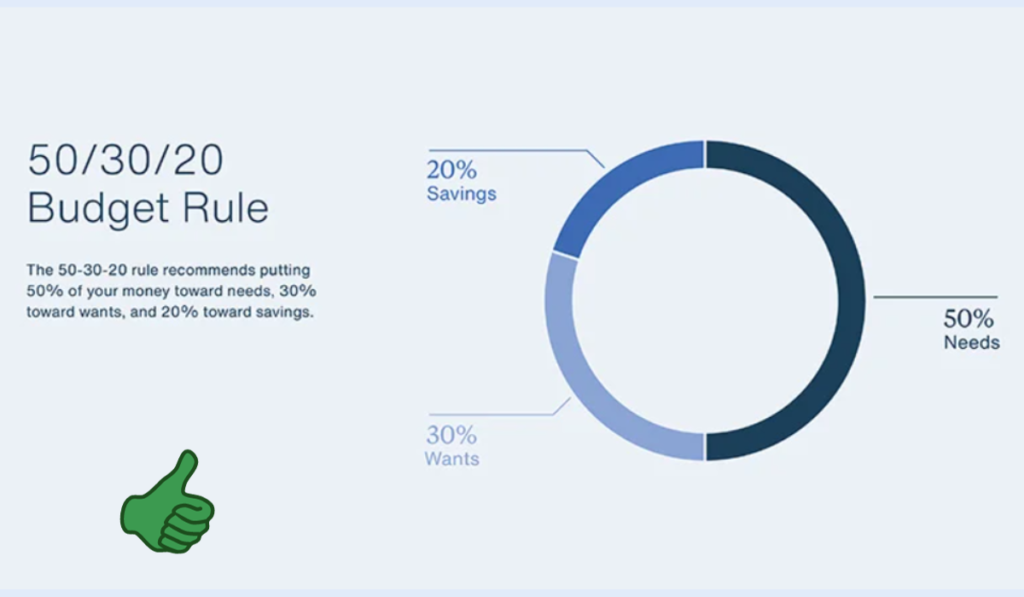

The 50/30/20 rule is a budgeting principle that suggests dividing your monthly income into three main categories: needs, wants, and savings. Here’s a analysis of how it works:

- 50% for Needs: The initial segment, constituting 50% of your income, is designated for your fundamental needs. This covers Important expenses like rent or Home Loan payments, groceries, transportation, and Medical Expenses. Essentially, any expenditure vital for sustaining a decent quality of life falls into this category, adding an Indian touch and a personal touch to your financial planning.

- 30% for Wants: The next segment, making up 30% of your income, is earmarked for your desires or flexible spending. This covers indulgences such as dining out, entertainment, shopping for non-essential items, hobbies, and vacations. In essence, anything that brings you joy but isn’t an absolute necessity falls within this category, blending an Indian flair with a personal touch to your financial strategy.

- 20% for Savings: The final category, making up 20% of your income, is designated for savings and debt repayment. This includes contributions to your emergency fund, retirement savings, investments, paying off debt, and other long-term financial goals. Allocating a significant portion of your income to savings is crucial for building wealth and ensuring financial security.

Applying the 50/30/20 Rule in Real Life

Now as we have a clear understanding of the 50/30/20 rule, let’s see how it can be applied in real life. We will explore each category in detail, providing tips and strategies to help you successfully implement this budgeting rule.

Needs (50%)

- Housing Expenses: Rent or mortgage payments typically make up a significant portion of your needs category. While it can be challenging to reduce these expenses, consider exploring options such as downsizing, living with roommates, or negotiating lower rental rates.

- Utilities: Review your utility bills and identify areas where you can save money. Simple changes, such as turning off lights when not in use, using energy-efficient appliances in home, can significantly reduce your utility expenses.

- Transportation: Evaluate your transportation costs and explore alternative options like carpooling, public transportation, or even cycling or walking if feasible. Additionally, keeping up with regular vehicle maintenance can help avoid costly repairs down the line.

- Groceries: Opt for budget-friendly meal planning and consider purchasing generic or store-branded products. Avoid shopping when you’re hungry and make a shopping list to prevent impulse purchases. Utilize coupons and take advantage of sales to stretch your grocery budget further.

- Healthcare: Health is wealth, and ensuring you have adequate insurance coverage is essential. Shop around for the best insurance plans and consider preventive measures to avoid costly medical bills in the future.

Wants (30%)

- Dining Out: While relishing a meal outside can be a delightful experience, it has the potential to swiftly nibble away at your budget. Set a realistic dining-out budget and try limiting the frequency of eating at restaurants. opt for cooking at home and explore new recipes to satisfy your taste buds.

- Entertainment: Cut back on expensive outings and find low-cost or free alternatives to keep yourself entertained. Consider exploring local parks, community events, or starting a hobby that doesn’t break the bank.

- Shopping: Impulse buying is the enemy of your budget. Before you hit the buy button, pause and reflect: Is this something you genuinely need? Consider waiting for sales or exploring pre-owned options to save money.

- Vacations: Planning a vacation is exciting, but it’s crucial to budget accordingly. Look for travel deals, consider traveling during off-peak seasons, and explore cost-effective destinations. Spending money on experiences is priceless, yet striking a balance that Aligns with your budget is crucial.

Savings (20%)

- Emergency Fund: Building an emergency fund is essential for financial peace of mind. Make it a goal to stash away a safety net of three to six months’ worth of living expenses. This buffer can be a lifesaver during unforeseen events like job loss or medical emergencies.

- Retirement Savings: Embark on your retirement savings journey early—it’s never too soon to begin. Check retirement plans or accounts that matches with your financial aspirations, like a 401(k) or Roth IRA. Contribute regularly and take advantage of any employer matching programs.

- Debt Repayment: If you’ve got lingering debts, consider earmarking a portion of your savings to settle them. Start with high-interest debts first and consider consolidation options to streamline your repayment process.

- Other Financial Goals: Set aside money for specific financial goals, like purchasing a home, starting a new business, or taking a new step in your education. The key is to prioritize your goals and allocate funds accordingly.

READ MORE: Smart Way of Saving Money in 2024

READ MORE: 50/30/20 Budget Rule Explained With Examples

Conclusion

To sum it all up, dost, the 50/30/20 rule is a surefire way to get your finances in shape. By dividing your income into necessary Requirements, and savings, you will be able to control your money and reach on your way to your financial goals. Remember, budgeting is a journey, not a destination, so always keep reviewing and adjusting your budget as your needs of life changes. Now go forth and conquer your finances with the power of the 50/30/20 rule!

1 thought on “Did You Know 50/30/20 Rule of Budgeting ?”